SpotLoan, the flexible alternative to traditional payday loans. In this article, we will provide an in-depth overview of SpotLoan, explaining how it works and why it may be the right choice for your financial needs. If you’re looking for a payday loan alternative that offers more flexibility and potentially lower interest rates, SpotLoan could be the solution for you.

Key Takeaways:

- SpotLoan offers a flexible alternative to traditional payday loans.

- It provides borrowers with a potentially lower interest rate and the ability to build credit history.

- SpotLoan’s application process is straightforward and can be completed online.

- Understanding the terms and conditions of SpotLoan is crucial before considering this option.

- Real customers have shared success stories and positive experiences with SpotLoan.

What is SpotLoan and How Does it Work?

Understanding the Basics of SpotLoan

SpotLoan is a payday loan alternative that offers individuals the ability to access quick funds to meet their immediate financial needs. Unlike traditional payday loans, SpotLoan provides a more flexible and transparent borrowing experience, empowering borrowers with greater control over their finances.

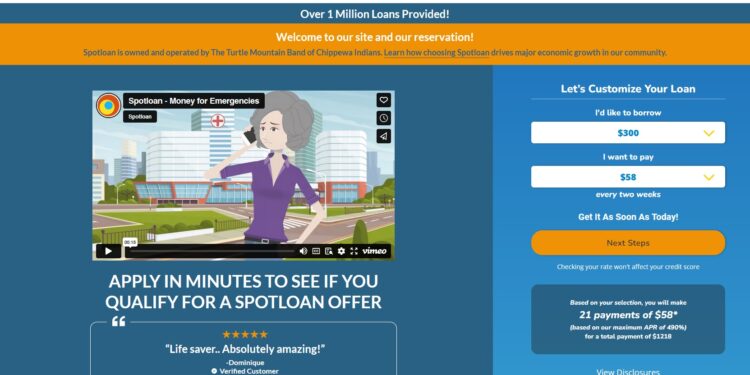

With SpotLoan, borrowers can apply for loans ranging from $300 to $800, depending on their eligibility. This alternative option allows for manageable repayment terms, typically spread over a period of several months. This extended repayment period provides borrowers with the flexibility they need to handle unexpected expenses without the added pressure of a lump sum payment.

In addition to its flexibility, SpotLoan offers transparency and clarity regarding loan terms and conditions. Borrowers know exactly how much they will owe, including the interest rates and fees, before accepting the loan offer. This ensures that borrowers are fully informed and can make decisions that align with their individual financial goals.

The Application Process Explained

Applying for a SpotLoan is a straightforward process that can be completed entirely online. Borrowers can start by visiting the SpotLoan website and filling out a simple application form. The application requires basic personal and financial information, and most borrowers can complete it in just a few minutes.

Once the application is submitted, SpotLoan reviews the information provided and makes a decision promptly. If approved, borrowers receive a loan offer that outlines the terms and conditions, including the repayment schedule, interest rates, and any applicable fees.

If the borrower accepts the loan offer, the funds are typically deposited into their bank account within one business day. This quick and convenient process allows individuals to access the funds they need without delay, providing relief for urgent financial situations.

SpotLoan vs. Traditional Payday Loans

SpotLoan differentiates itself from traditional payday loans in several ways. Unlike traditional payday loans that require repayment in full on the borrower’s next payday, SpotLoan offers more flexible repayment terms. This allows borrowers to make smaller, more manageable payments over a longer period, reducing the risk of falling into a cycle of debt.

Additionally, SpotLoan does not require a credit check for loan approval. Instead, eligibility is based on income and other factors, giving individuals with less-than-perfect credit histories the opportunity to borrow funds when needed. This makes SpotLoan a viable alternative for those who may not qualify for traditional loans due to credit challenges.

While traditional payday loans often come with high interest rates and hidden fees, SpotLoan provides borrowers with transparent and upfront information about the costs associated with the loan. This transparency ensures that borrowers understand the total amount they will owe and can make an informed decision.

In summary, SpotLoan offers a flexible and responsible alternative to traditional payday loans, providing borrowers with the opportunity to access funds quickly and manage their repayments in a more sustainable manner.

SpotLoan’s Terms and Conditions: What Borrowers Need to Know

In order to make an informed decision about SpotLoan, it’s crucial to understand the terms and conditions associated with this alternative loan option. This section will provide a detailed overview of the APR and fee structure, repayment schedule insights, and eligibility criteria for borrowers.

APR and Fee Structure

When considering SpotLoan, borrowers should be aware of the APR (Annual Percentage Rate) and fee structure. The APR represents the cost of borrowing over a year and takes into account the interest rate and any additional fees. SpotLoan offers competitive interest rates and transparent fee structures, ensuring that borrowers have a clear understanding of the total cost involved.

Repayment Schedule Insights

Understanding the repayment schedule is essential for borrowers considering SpotLoan. SpotLoan offers flexibility in repayment, allowing borrowers to choose a repayment schedule based on their financial situation. It’s important to review the repayment terms and schedule to ensure that it aligns with your ability to repay the loan comfortably.

Eligibility Criteria for Borrowers

In order to qualify for SpotLoan, borrowers must meet certain eligibility criteria. These criteria may include age restrictions, proof of income, and a valid bank account. By outlining the eligibility criteria, SpotLoan ensures that borrowers who meet the requirements can access the funds they need in a timely manner.

The Benefits of Choosing SpotLoan Over Other Payday Loans

When it comes to payday loan alternatives, SpotLoan stands out for its numerous benefits and advantages. Whether you’re in need of quick cash or looking to build your credit history, SpotLoan offers a flexible solution that can meet your financial needs.

One of the key advantages of SpotLoan is its flexibility. Unlike traditional payday loans that typically require repayment in a lump sum, SpotLoan gives you the option to repay your loan in installments, making it easier to manage your finances.

Additionally, SpotLoan offers potentially lower interest rates compared to other payday loan options. This means that you may be able to save money on interest charges, providing you with more financial flexibility.

Furthermore, SpotLoan also allows borrowers to build their credit history through responsible borrowing. By making timely repayments on your SpotLoan, you can demonstrate your financial responsibility and improve your credit score over time.

Overall, SpotLoan offers a range of benefits that set it apart from other payday loan alternatives. Its flexibility, potentially lower interest rates, and credit-building opportunities are just a few reasons why SpotLoan may be the right choice for your financial circumstances.

Real Customer Experiences with SpotLoan

SpotLoan has garnered numerous success stories from satisfied customers who have benefited from its flexible financial solutions. These success stories shed light on the positive impact SpotLoan has had on individuals facing various financial emergencies.

Success Stories of Using SpotLoan

One customer, Sarah, found herself in a tight spot when her car broke down unexpectedly, leaving her unable to commute to work. With no savings to cover the repair costs, Sarah turned to SpotLoan for assistance. SpotLoan approved her application swiftly, and she received the funds within 24 hours. Thanks to SpotLoan, Sarah was able to repair her car and maintain her job, avoiding financial instability.

Another success story involves Mark, who experienced a medical emergency that required immediate hospitalization. Despite having health insurance, Mark faced high out-of-pocket expenses that he couldn’t afford at the time. In his desperate situation, Mark turned to SpotLoan for help. SpotLoan’s fast approval process ensured he received the necessary funds to cover his medical bills promptly. This allowed Mark to focus on recovering rather than worrying about the financial burden.

How SpotLoan Helped in Financial Emergencies

SpotLoan has been a reliable source of support for individuals facing unexpected financial emergencies. Whether it’s a car repair, medical expense, or home repair, SpotLoan has proved instrumental in providing quick access to funds. SpotLoan’s straightforward application process and fast approval times have alleviated the stress and urgency associated with these emergencies, ensuring individuals can address their financial needs promptly.

Navigating Through the SpotLoan Platform: User Feedback

SpotLoan’s user-friendly platform has received positive feedback from borrowers. Users appreciate the intuitive design and ease of navigation, which simplifies the loan application process. Many customers have reported that the SpotLoan platform is user-friendly, secure, and transparent. With easy-to-understand instructions and clear terms and conditions, borrowers can navigate through the platform with confidence, making their overall experience with SpotLoan a pleasant one.

Additionally, users have praised SpotLoan’s responsive customer support. Whether through email, phone, or live chat, SpotLoan’s support team is readily available to address queries, guide borrowers through the application process, and provide necessary assistance throughout the loan term. This level of support has further enhanced user experience and trust in the SpotLoan brand.

SpotLoan’s Customer Service and Support

In addition to providing a reliable payday loan alternative, SpotLoan prioritizes excellent customer service and support. We understand that navigating the loan process can be overwhelming, and our dedicated team is here to assist borrowers every step of the way.

At SpotLoan, we offer multiple channels of communication to ensure that our customers can reach us easily and conveniently. Whether you have a question or need assistance with your loan application, our knowledgeable customer service representatives are available via phone, email, and live chat.

Our customer support team is highly trained and committed to providing prompt and efficient service. We strive to address inquiries and resolve any concerns in a timely manner, ensuring that our borrowers feel supported throughout their loan experience.

In addition to our responsive customer service, SpotLoan offers a range of features designed to enhance borrower support. Our online platform is user-friendly and intuitive, making it easy for customers to manage their loans and access important information. We provide detailed loan agreements and repayment schedules upfront, allowing borrowers to review and understand the terms and conditions before accepting the loan.

SpotLoan’s commitment to customer service and support sets us apart from traditional payday loan options. We believe in establishing long-term relationships with our borrowers and providing them with the assistance they need to make informed financial decisions.

Whether you have a question or need guidance, our dedicated customer service team is ready to help. Contact SpotLoan today to experience our exceptional customer support firsthand.

Alternatives to SpotLoan: Other Online Payday Loans and Options

While SpotLoan may be a suitable option for some individuals seeking payday loans, it’s always a good idea to explore alternative options. In this section, we will discuss other online lenders and traditional payday loans, as well as provide insights on financial planning to avoid the need for payday loans altogether.

Comparing SpotLoan with Other Online Lenders

When considering an online payday loan, it’s essential to compare different lenders to find the one that best suits your needs. While SpotLoan offers flexibility and convenience, other online lenders may have different terms and conditions. By comparing these lenders, you can evaluate factors such as interest rates, repayment schedules, and eligibility criteria to make an informed decision.

Traditional Payday Loans vs. Online Options

Traditional payday loans, typically obtained from brick-and-mortar stores, have been a common option for individuals facing short-term financial challenges. However, online payday loans offer certain advantages over their traditional counterparts. They provide convenience, allowing borrowers to apply from the comfort of their homes, and often have streamlined application processes. Online options also offer increased accessibility, as they are available to individuals in various locations.

However, it’s essential to consider the potential disadvantages as well. Online payday loans may have higher interest rates compared to traditional loans. Additionally, borrowers must exercise caution when selecting online lenders, as not all are reputable or regulated. Conducting thorough research and reading customer reviews is crucial.

Financial Planning: Avoiding the Need for Payday Loans

While payday loans can provide temporary relief, it’s essential to develop healthy financial habits and avoid relying on them in the long run. Engaging in financial planning can help you stay on top of your expenses and build a strong financial foundation. Creating a budget, tracking your spending, and establishing an emergency fund are all ways to manage your finances effectively. Additionally, exploring options like credit counseling and seeking advice from financial professionals can provide valuable insights and guidance.

By prioritizing financial planning and taking proactive steps to manage your money, you can reduce the need for payday loans and ensure a more secure financial future.

Conclusion

SpotLoan offers a flexible alternative to traditional payday loans, providing borrowers with a reliable solution for their financial needs. Throughout this article, we have explored the key features and benefits of SpotLoan, enabling readers to make an informed decision.

By choosing SpotLoan, borrowers can enjoy several advantages. Unlike traditional payday loans, SpotLoan offers a more flexible repayment schedule, allowing borrowers to manage their payments according to their individual circumstances. Additionally, SpotLoan may provide lower interest rates compared to other payday loan options, potentially saving borrowers money in the long run.

In conclusion, SpotLoan stands as a viable alternative for individuals seeking a payday loan alternative. Its user-friendly platform, transparent terms and conditions, and responsive customer support make it a reputable choice. However, as with any financial decision, borrowers should carefully consider their own needs and circumstances before committing to a loan. SpotLoan provides a valuable option for those who need financial assistance, and its numerous benefits make it worth exploring further.