Welcome to our comprehensive overview of Hugo Insurance. If you’re looking for reliable coverage, affordable plans tailored to your needs, and the peace of mind that comes with securing your future, Hugo Insurance may be the perfect choice for you.

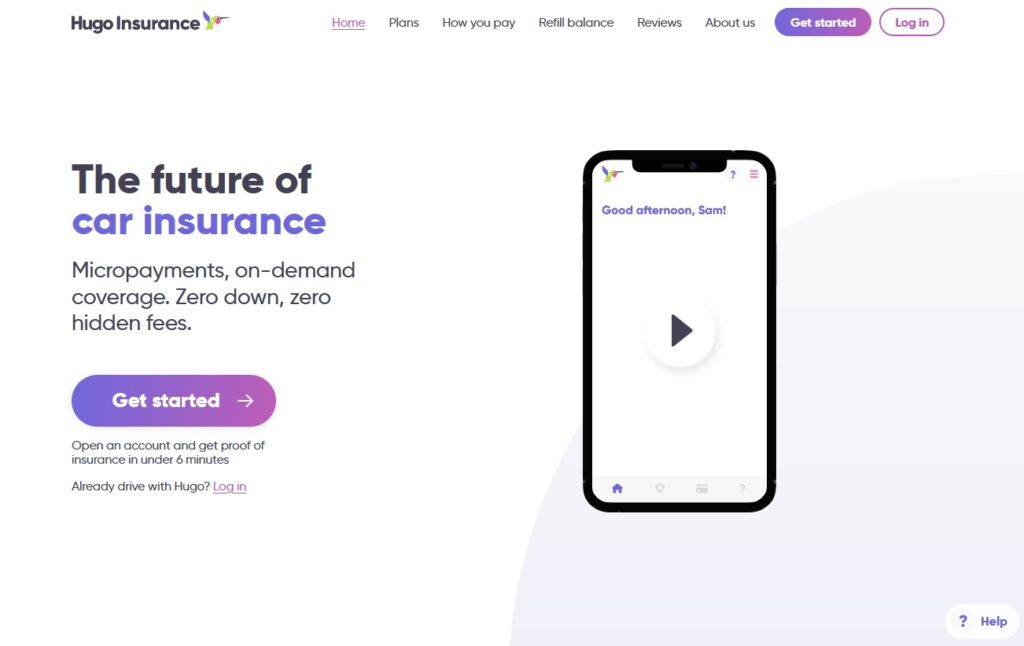

Hugo Insurance stands out from traditional insurance options by offering unique features and simplified processes that make obtaining insurance coverage a breeze. With their intuitive online platform and user-friendly tools, Hugo Insurance has revolutionized the insurance industry.

In this article, we will explore the key features and benefits of choosing Hugo Insurance. We will discuss the different insurance plans they offer, including personal insurance for auto, home, and life coverage, as well as commercial coverage options for businesses of all sizes.

Additionally, we will analyze customer reviews and testimonials to highlight the positive experiences and customer satisfaction that policyholders have experienced with Hugo Insurance. By examining real-life experiences, you can gain valuable insights into the quality of service and coverage provided by Hugo Insurance.

Furthermore, we will compare Hugo Insurance with traditional providers to showcase the innovative policy management tools and features that set Hugo Insurance apart. We will also conduct a cost and service comparison to help you assess the value and advantages of choosing Hugo Insurance over more traditional options.

By the end of this article, you will have a clear understanding of whether Hugo Insurance is the right choice for your coverage needs. We will summarize the pros and cons and provide insights into the future outlook for Hugo Insurance and the insurance industry as a whole.

Key Takeaways:

- Hugo Insurance offers reliable coverage tailored to your needs

- Their plans are affordable and provide peace of mind for the future

- Hugo Insurance simplifies the insurance process with their user-friendly tools

- They offer a range of personal and commercial insurance options

- Customer reviews and testimonials highlight positive experiences

Understanding Hugo Insurance: What Sets It Apart

In this section, we will delve deeper into what sets Hugo Insurance apart from other providers. We will highlight its key features and discuss how it simplifies the insurance process. By understanding these unique attributes, you can make an informed decision about whether Hugo Insurance is the right choice for your coverage needs.

Key Features of Hugo Insurance

Hugo Insurance stands out from other providers due to its range of unique features. One of its key highlights is the ability to customize insurance plans to suit your specific needs. Whether you’re looking for coverage for your home, vehicle, or life, Hugo Insurance offers tailored plans that provide the right level of protection.

Another notable feature is Hugo Insurance’s commitment to excellent customer service. With a team of dedicated professionals, they prioritize customer satisfaction and ensure that policyholders receive prompt and reliable support throughout their coverage journey.

How Hugo Insurance Simplifies the Insurance Process

Unlike traditional insurance providers, Hugo Insurance adopts a modern approach to simplify the insurance process. With an intuitive online platform, policyholders can easily manage their coverage, access digital policies, and make changes in real-time. This streamlines the experience and eliminates the hassle of paperwork or phone calls.

Additionally, Hugo Insurance provides user-friendly tools that make it easy to understand policy terms, coverage limits, and deductibles. This transparency empowers customers to make well-informed decisions and ensures that they have a clear understanding of their policy details.

The Benefits of Choosing Hugo Insurance for Your Coverage

When it comes to insurance coverage, Hugo Insurance stands out as a reliable and trusted provider. With a commitment to offering peace of mind, Hugo Insurance ensures that policyholders receive the protection they need and deserve. One of the significant benefits of choosing Hugo Insurance is their tailored plans, which can be customized to fit individual needs.

One of the key advantages of Hugo Insurance is their reliable coverage. Policyholders can rest assured knowing that their insurance needs are being taken care of by a reputable and trustworthy company. Whether it’s auto, home, life, or any other type of coverage, Hugo Insurance offers comprehensive plans that provide peace of mind.

Another standout feature of Hugo Insurance is their tailored plans. Unlike traditional insurance providers, Hugo Insurance understands that every individual’s needs are unique. They offer customized plans that allow policyholders to select the specific coverage options that are most relevant to them. By tailoring their plans, Hugo Insurance ensures that customers only pay for the coverage they truly need, eliminating unnecessary expenses.

Choosing Hugo Insurance means choosing an insurance provider that prioritizes customer satisfaction and offers peace of mind. With their reliable coverage and tailored plans, Hugo Insurance sets a new standard in the industry. Whether you’re looking for personal or commercial insurance coverage, Hugo Insurance is here to protect what matters most.

Hugo Insurance Plans: Options and Coverage Details

In this section, we will provide a detailed overview of the insurance plans offered by Hugo Insurance. We understand the importance of finding the right coverage for your needs, whether it’s for personal insurance or commercial coverage. Hugo Insurance offers a wide range of options to cater to both individuals and businesses.

Personal Insurance Plans by Hugo

When it comes to personal insurance, Hugo Insurance has you covered. They offer comprehensive plans designed to protect what matters most to you. Whether you’re looking for auto insurance to safeguard your vehicle, home insurance to protect your property, or life insurance to provide financial security for your loved ones, Hugo Insurance has tailored plans to suit your needs.

With Hugo Insurance’s personal insurance plans, you can have peace of mind knowing that you are protected against unexpected events and emergencies. Their coverage limits, deductibles, and additional benefits are all designed to provide you with the right level of protection without breaking the bank.

Commercial Coverage Options

For businesses of all sizes, Hugo Insurance offers comprehensive commercial coverage options. Whether you’re a small business owner or managing a larger enterprise, Hugo Insurance can provide the coverage you need to protect your assets, employees, and operations.

From general liability insurance to protect against third-party claims to property insurance that safeguards your physical assets, Hugo Insurance has the expertise and resources to meet your business insurance needs. They also offer specialized coverage options tailored to specific industries, ensuring that you have the right protection for your unique risks and challenges.

When it comes to commercial coverage, Hugo Insurance understands that no two businesses are the same. Their customizable plans allow you to choose the coverage that best fits your business, providing you with the flexibility and peace of mind you need to focus on what matters most – running your business.

Overall, Hugo Insurance provides a wide range of insurance plans, both for personal and commercial needs. Their comprehensive details, coverage options, and commitment to tailored coverage make them a reliable choice for anyone looking for reliable insurance coverage.

Analyzing Customer Reviews and Testimonials of Hugo Insurance

In order to gain valuable insights into the quality of service and coverage provided by Hugo Insurance, it is important to analyze customer reviews and testimonials. By examining the experiences of policyholders, potential customers can gauge the level of customer satisfaction and positive experiences associated with Hugo Insurance.

“I have been a Hugo Insurance customer for several years and I couldn’t be happier with their service. Their team is always responsive and helpful, and their coverage options are comprehensive and tailored to my needs. I highly recommend Hugo Insurance to anyone looking for reliable and affordable insurance.” – Sarah Thompson, Hugo Insurance Policyholder

Testimonials like Sarah’s highlight the positive experiences and satisfaction that many customers have with Hugo Insurance. These reviews serve as a testament to the company’s dedication to customer service and their ability to provide peace of mind through reliable coverage.

Another customer, John Ramirez, shared his satisfaction with Hugo Insurance’s claims process:

“I recently had to file a claim with Hugo Insurance and I was amazed at how easy and efficient the process was. Their claims team was prompt and handled everything smoothly, ensuring that I received the compensation I needed. I am grateful to have Hugo Insurance on my side.” – John Ramirez, Hugo Insurance Policyholder

These testimonials demonstrate the positive experiences that Hugo Insurance policyholders have had when dealing with claims. Their efficient and reliable claims process reflects the company’s commitment to providing excellent service to their customers.

By analyzing customer reviews and testimonials, potential policyholders can gain valuable insights into the level of customer satisfaction and positive experiences associated with Hugo Insurance. These real-life experiences provide reassurance and confidence in choosing Hugo Insurance for their coverage needs.

Hugo Insurance Vs. Traditional Insurance Providers

In today’s insurance landscape, many individuals and businesses are seeking alternatives to traditional insurance providers. One such alternative is Hugo Insurance, an innovative insurtech company that offers a range of unique features and benefits. In this section, we will explore how Hugo Insurance compares to traditional providers, focusing on its innovative policy management and cost-effectiveness.

Innovation in Policy Management with Hugo

One of the key factors that sets Hugo Insurance apart from traditional providers is its innovative approach to policy management. Unlike traditional insurance companies that rely on complex and bureaucratic processes, Hugo Insurance offers a simplified and intuitive online platform. With Hugo Insurance, policyholders can easily manage their policies, make changes, and access important information with just a few clicks. This streamlined policy management experience not only saves time and effort but also ensures transparency and convenience for policyholders.

Comparing Costs and Services

When it comes to choosing an insurance provider, cost is always an important consideration. Hugo Insurance understands this and strives to offer cost-effective solutions to its customers. Through advanced data analytics and risk assessment algorithms, Hugo Insurance is able to offer tailored insurance plans that provide comprehensive coverage at competitive prices. By eliminating unnecessary overhead costs and leveraging technological advancements, Hugo Insurance offers cost savings without compromising on coverage quality.

Additionally, Hugo Insurance provides a range of services that go beyond traditional insurance offerings. These services may include personalized risk assessments, proactive claims management, and access to a network of preferred service providers. By providing these additional services, Hugo Insurance aims to enhance the overall insurance experience for its customers and provide value beyond basic coverage.

When comparing Hugo Insurance with traditional providers, it becomes evident that Hugo Insurance offers a more modern and customer-centric approach to insurance. Its innovative policy management tools, cost-effective plans, and additional services set it apart from traditional options, providing policyholders with a hassle-free and tailored insurance experience.

Hugo Insurance: Is It the Right Choice for You?

When it comes to choosing the right insurance provider, there are several factors to consider. One of the key considerations is the coverage suitability offered by the insurance company. Hugo Insurance understands that every individual has unique needs and provides tailored insurance plans to meet those specific requirements. Whether you’re looking for personal insurance coverage or commercial options, Hugo Insurance ensures that you only pay for the coverage you truly need.

Another important aspect to consider is industry expertise. Hugo Insurance has years of experience in the insurance industry and understands the complexities and nuances of different coverage types. Their industry expertise ensures that you receive the best possible advice and guidance when selecting the right insurance plan.

Choosing Hugo Insurance means choosing a provider that prioritizes your individual needs and offers comprehensive coverage options. With a focus on reliability and customer satisfaction, Hugo Insurance is committed to providing you with peace of mind knowing that your future is secure. When making your insurance decision, consider Hugo Insurance and their industry expertise to ensure that you’re making the right choice for your coverage needs.

Navigating Hugo Insurance Alternatives

When it comes to choosing an insurance provider, it’s essential to consider all your options. In this section, we will explore alternatives to Hugo Insurance and compare it with other insurtech companies operating in the insurance industry. Evaluating insurance needs against Hugo Insurance’s offerings will help you make an informed decision about your coverage.

Comparing Hugo Insurance with Other Insurtech Companies

While Hugo Insurance offers a range of benefits and features, it’s important to compare it with other insurtech companies in the market. By conducting a thorough comparison, you can gain a better understanding of the unique advantages and disadvantages each company provides. Consider factors such as coverage options, pricing, customer service, and overall reputation to determine which company aligns best with your needs.

Evaluating Your Insurance Needs Against Hugo’s Offerings

To determine if Hugo Insurance is the right fit for you, it’s crucial to evaluate your insurance needs. Every individual’s or business’s coverage requirements are unique. Assess factors such as the type of coverage you need, the level of protection required, and any specific industry or personal considerations. By aligning your insurance needs with Hugo Insurance’s offerings, you can ensure that you receive tailored coverage that meets your specific requirements.

Conclusion

Summarizing the Pros and Cons of Hugo Insurance:

Choosing Hugo Insurance for coverage comes with several notable advantages. First, the company offers reliable coverage options that provide policyholders with peace of mind. With Hugo Insurance, individuals can tailor their plans to suit their specific needs, ensuring they only pay for the coverage they require. The company’s commitment to excellent customer service also sets it apart, as policyholders can expect assistance and support throughout their insurance journey.

While Hugo Insurance has many positives, it’s important to consider a few potential drawbacks. Some individuals may find that the customization options come with higher premiums compared to more standardized insurance plans. Additionally, there are limitations to the coverage offered, and certain specific situations may require additional coverage from other providers.

Future Outlook for Hugo Insurance and the Industry

Looking ahead, Hugo Insurance is well-positioned to continue its growth in the insurance industry. As an insurtech company, Hugo Insurance has leveraged technology to simplify the insurance process, making it more accessible and convenient for customers. This innovative approach sets the stage for further advancements in the industry, as more companies adopt similar digital solutions to enhance their offerings.

Additionally, with the increasing reliance on digital platforms and data analytics, Hugo Insurance could further improve its policy management tools and predictive capabilities. By leveraging technology and data, Hugo Insurance can continue to enhance its services, providing policyholders with even more tailored and cost-effective coverage options.

Looking beyond Hugo Insurance, the broader insurance industry is likely to experience ongoing digital transformation. Insurtech companies are challenging traditional providers by offering innovative solutions, streamlined processes, and personalized experiences. As technology continues to evolve, insurance companies will need to adapt to changing consumer expectations and embrace digital strategies to remain competitive in the market.

FAQ

What is Hugo Insurance?

Hugo Insurance is a comprehensive insurance provider offering reliable coverage and affordable plans tailored to your needs. With Hugo Insurance, you can secure your future and protect what matters most to you.

What sets Hugo Insurance apart from traditional options?

Hugo Insurance stands out from traditional options due to its unique features and simplified insurance process. They offer customizable plans, excellent customer service, and an intuitive online platform that makes managing your insurance easy and convenient.

What are the benefits of choosing Hugo Insurance?

Choosing Hugo Insurance comes with numerous benefits. You can expect reliable coverage that provides peace of mind, as well as tailored plans that can be customized to fit your individual needs. With Hugo Insurance, you only pay for the coverage you truly need.

What insurance plans does Hugo Insurance offer?

Hugo Insurance provides a range of insurance plans, including personal insurance options such as auto, home, and life insurance. They also offer commercial coverage options to cater to businesses of all sizes. Each plan comes with comprehensive details, including coverage limits, deductibles, and additional benefits.

What do customers say about Hugo Insurance?

Customer reviews and testimonials of Hugo Insurance highlight positive experiences and high levels of customer satisfaction. Policyholders appreciate the quality of service and coverage provided by Hugo Insurance.

How does Hugo Insurance compare to traditional providers?

Hugo Insurance stands out from traditional providers through its innovative policy management tools and features. They offer a user-friendly online platform that simplifies the insurance process. Additionally, conducting a cost and service comparison can help determine the advantages of choosing Hugo Insurance over traditional options.

Is Hugo Insurance the right choice for me?

Choosing the right insurance provider depends on factors such as coverage suitability, individual needs, and industry expertise. It is advisable to assess whether Hugo Insurance aligns with your specific requirements before making a decision.

What are the alternatives to Hugo Insurance?

If you’re considering alternatives to Hugo Insurance, you can compare it with other insurtech companies operating in the insurance industry. Additionally, evaluating your insurance needs against Hugo Insurance’s offerings can help you make an informed decision about your coverage.

What is the conclusion for Hugo Insurance?

In conclusion, Hugo Insurance provides reliable coverage and tailored plans. While it has numerous benefits, it’s important to weigh the pros and cons before making a decision. Considering the future outlook for Hugo Insurance and the insurance industry in general can also be helpful in assessing long-term viability and trends.