Earlier, the role of CFOs was primarily pretty straightforward. Their role was to take care of the company books and records, report financial standings, and ensure compliance. This included tracking cash flow, analyzing the company’s financial strengths and weaknesses, making financial plans, and proposing strategic directions.

But the role of a CFO is constantly evolving, considering the new set of normals that need to decode and gain control over. This explains why external CFOs get insurance to protect themselves against professional risks.

In addition to providing strategic financial advice and offering financial expertise to the company’s directors and board members, their job is to be a business partner. Therefore, they have to be involved in human resources and employee management, internal and external legal regulations, business strategy, administrative and overall company operations.

As the modern workforce becomes more and more high-tech, top CFOs need to be aware of the right tools that can help them overcome new challenges and set their teams up for success. To help you get the upper hand, here is a quick list of the must-have software to help your teams grow.

Some things you should consider before jumping in

Whether you’re looking for an expense management software, payroll tools, or time tracking software, the marketplace has plenty of options for you to consider. Here, we’ve listed down some key principles that you might want to consider when looking for specific tools:

- An all-in-one tool might not be the best answer. As much as you may want a single tool that does all the work, it can prove to be more challenging down the road. E.g., large ERP systems are difficult to integrate with other tools, and it can take up a lot of time and energy to keep them running smoothly.

- It’s perfectly fine to go for a wide range of tools. With modern technology, CFOs can rely on a suite of tools to achieve their desired results. For example, you may want an accounting tool with expense reporting capabilities, but your current accounting tool may not have strong expense management build. In this case, you can go for an expense report software that can sync with your accounting tool seamlessly.

- Ensure you’re able to keep the tool for the long term. Your finance team deals with a large volume of valuable data daily, and you may want to avoid switching tools every few months. While finalizing on software, ensure it can do exactly what you expect to prevent unnecessary switches.

- Don’t rush in. Take inputs from the team. Ideally, you’d want to avoid switching to different tools because the transition would take time and cost your company business. Therefore, before sealing the deal, sit through sales demos with team members who will be using the tools and evaluate the tools together.

Some of our top picks you might want to check out

Fyle- Expense management software

Fyle is a new-age expense management software built to streamline expense management processes from expense reporting to reimbursing employees. The expense tool automates and takes care of repetitive expense reporting and managing tasks and helps boost employee productivity.

With Fyle, Finance teams can easily manage employee expense reports under one platform and ensure complete visibility and control of business expenses. The expense tool can also seamlessly integrate with your favorite accounting software, like Netsuite, Quickbooks Online, and Sage Intacct.

Feature benefits for CFOs and their team:

- Ensure policy compliance and curb potential fraud with their real-time policy engine that ensures only compliant expenses get through.

- Control overspending on projects and forecast accurate spending with Fyle’s real-time visibility, actionable insights, and pre-spend controls.

- Gain insights into employee business expense behavior, finance operations, and spending patterns.

- Get timely expense reports and close reimbursement cycles in an audit-ready manner

- Optimize your finance team’s productivity by automating the credit card reconciliations process.

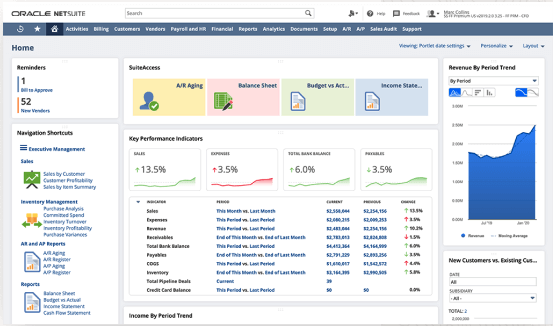

NetSuite ERP is a cloud business management tool that can enable organizations to operate more efficiently. The tool can automate core processes and provide real-time visibility into operational and financial performance. Additionally, the Finance team can integrate their existing applications with Netsuite to manage accounts, inventories, process orders, supply chains, and warehouse operations.

Feature benefits for CFOs and their team:

- Maintain data consistency across the entire organization and ensure compliance with accounting standards, legal bodies, tax codes, and internal company policies.

- The Netsuite cloud infrastructure eliminates the need to maintain hardware, servers, databases, backups, upgrades, and IT infrastructure.

- Make better and faster business decisions with built-in, real-time financial dashboards, reporting, and analytics.

- Allow your Finance team to focus on more important tasks by automating repetitive tasks, such as creating journal entries, reconciling account statements, etc.

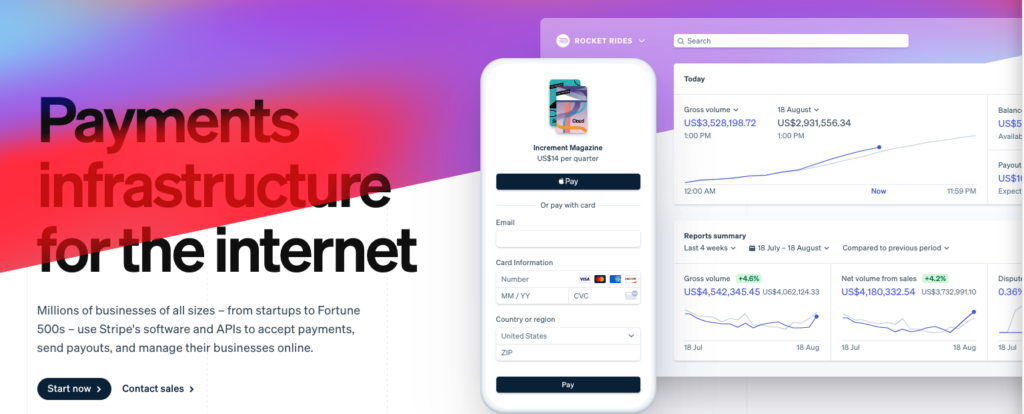

Stripe- Payment processing tool

Stripe makes online payment processing borderless and straightforward. The tool is highly scalable, and its robust payment feature helps businesses issue invoices easily and accept credit payments through their app or website. Stripe has also made payment processing simply by removing the administrative burden of receiving and processing payments. In addition, the software is equipped with advanced financial tools that can easily integrate with your accounting suite.

Feature benefits for CFOs and their team:

- Create and customize payment forms with the tool’s user interface toolkit. You can easily embed checkout on your site by simply utilizing a Javascript line.

- The Finance team can also have a bird’ eye view of charges made across payment types, countries, and currencies via information exportability and real-time reporting.

- Streamline and make reconciliation of transactions quicker with their automated accounting support, collated reports, and financial reporting.

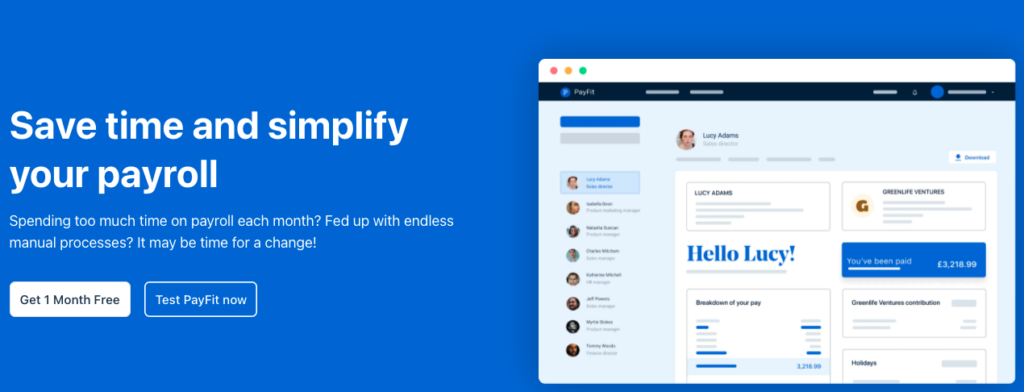

PayFit is an HMRC-certified payroll and HR management software designed to help small to midsize businesses. The software can automate the entire payroll lifecycle, from RTI submissions to leaves to expenses tracking.

Your team can utilize Payfit to maintain monthly payroll and accounting records in a journal. This data can also be downloaded in various formats and shared across organizations. In addition, PayFit enables businesses to store numerous administrative documents, including driving licenses, P45, payslips, contracts, and more, under one place.

Feature benefits for CFOs and their team:

- The Finance team can automatically generate payslips on the date you wish to run payroll and send emails to employees informing them about the new payslip.

- You can easily download payroll journals from the software and upload them directly to your existing accounting software.

- Save time by automating your payroll admin task with just a few clicks. Generate and distribute payslips, and update and view employee payslips in real-time, all while being HMRC compliant.

360Learning – Collaborative training

360Learning helps Finance teams drive culture and growth through Collaborative Learning. You can use their platform to onboard new teammates and train employees on critical department processes. In addition, 360Learning helps teams share their knowledge instead of keeping information siloed and susceptible to loss when employees leave.

Feature benefits for CFOs and their team:

- Anyone on the Finance team can create training material. Course creation is no longer limited to being a top-down function.

- Easily onboard new hires and rapidly get them up to speed on department processes.

- Compliance training for legal and financial responsibility for public companies.

Get the tools to achieve success with your team today!

Multiple core finance processes are manual, tedious, and repetitive that slow your team down. But, there are a lot of good tools out there that do all the heavy lifting for your team. By investing in these tools, you can help your team stay focused on strategy and achieve business goals without burning out.