Brex is a financial technology company that is transforming the way businesses manage their finances. With its innovative credit card solutions, Brex provides growing companies with streamlined financial services tailored to their specific needs. By offering a range of benefits and features, Brex is revolutionizing business finance and empowering companies to thrive in a competitive market.

Key Takeaways:

- Brex is a fintech company revolutionizing business finance

- Brex offers innovative credit card solutions for growing companies

- Brex provides tailored financial services to help businesses thrive

- Streamlined financial processes and automated tasks with Brex

- Brex is reshaping the future of business finance through advanced technology

Understanding the Fundamentals of Brex

What is Brex?

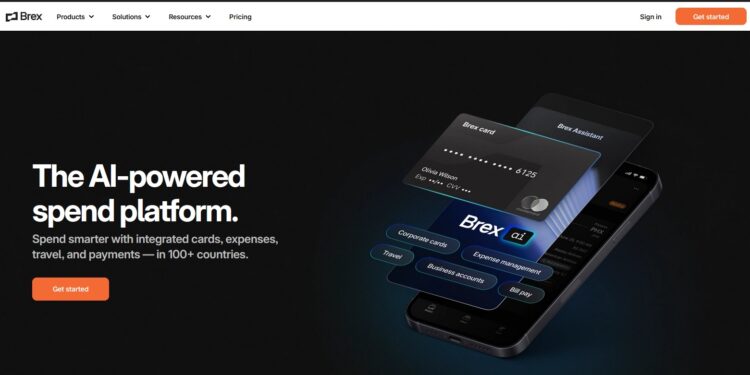

Brex is a fintech startup that offers corporate financial services, including a corporate credit card and cash management tools. The company was founded to address the unique financial challenges faced by startups and fast-growing businesses.

The Vision Behind Brex

The vision behind Brex is to simplify financial management for businesses by providing innovative solutions and leveraging technology. Brex aims to redefine traditional banking and offer products that align with the needs of modern businesses.

How Brex is Changing the Financial Landscape for Businesses

Brex is changing the financial landscape for businesses by providing fast and efficient financial services. Through its intuitive platform and automation capabilities, Brex enables companies to streamline their financial processes and make data-driven decisions.

Brex Credit Card: A New Age Financial Tool

Key Features and Benefits

The Brex credit card is a cutting-edge financial tool designed specifically for businesses. It offers higher credit limits compared to traditional corporate cards and is tailored for startups and growing companies.

Key features of the Brex credit card include expense tracking, automatic categorization, and seamless integration with accounting software. It also offers rewards programs tailored for business expenses.

Applying for a Brex Credit Card

Applying for a Brex credit card is a simple and straightforward process. Companies can apply online by providing basic information about their business, such as revenue, funding, and industry. Brex uses innovative underwriting technology to assess creditworthiness, making the application process efficient and fast.

The Brex Ecosystem: More Than Just a Credit Card

The Brex ecosystem goes beyond providing a credit card, offering businesses a comprehensive suite of financial tools to streamline their operations and enhance their financial management capabilities. This ecosystem includes Brex Cash, a digital banking solution, and Brex Rewards, a program designed to maximize value for users.

Brex Cash: Streamlining Business Banking

Brex Cash is a game-changer for businesses, providing them with a powerful digital banking solution to effectively manage their cash flow. With Brex Cash, businesses can easily make payments, track their expenses, and even earn interest on their funds. By eliminating the need for multiple banking platforms, Brex Cash simplifies business banking, saving time and reducing complexity.

Brex Rewards: Maximizing Value for Users

As part of the Brex ecosystem, the Rewards program offers businesses the opportunity to earn valuable rewards points on their everyday purchases. Designed specifically for business expenses, the program provides bonus points on categories such as software, advertising, and travel. These accumulated points can be redeemed for a variety of rewards, including travel, gift cards, and statement credits, allowing businesses to get even more value from their spending.

Brex for Startups: Empowering New Ventures

Startups face unique challenges when it comes to financing their business. Traditional banking services may not fully understand the needs and potential of a startup, making it difficult to access the necessary funds. Fortunately, Brex offers a tailored approach to financing specifically designed for startups, providing them with the financial tools and support they need to thrive.

Why do startups choose Brex? One of the primary reasons is Brex’s deep understanding of the startup ecosystem. Unlike traditional financial institutions, Brex comprehends the unique funding requirements, cash flow patterns, and growth strategies that startups follow. This allows Brex to provide financing solutions that cater specifically to these needs, empowering startups to access the funds they require to scale and succeed.

Additionally, Brex offers a range of benefits and features that are particularly valuable for startups. This includes higher credit limits compared to traditional credit cards, rewards programs tailored to business expenses, and automated expense tracking and categorization. These features not only simplify financial management for startups but also provide them with the tools to make data-driven decisions and optimize their spending.

Success Stories: Startups Thriving with Brex

Many startups have already experienced significant success with Brex by leveraging its innovative financial products and services. These success stories serve as inspiring examples of the impact Brex can have on a startup’s growth and success.

Noom, a popular health and wellness startup, has utilized Brex’s financing options to support its rapid expansion. By relying on Brex, Noom has been able to access the necessary capital to invest in marketing, technology infrastructure, and talent acquisition, ultimately fueling its growth and market reach.

Ironclad, a leading contract lifecycle management platform, has leveraged Brex’s credit card and rewards program to optimize its business expenses. By earning valuable rewards points on software and advertising expenses, Ironclad has been able to reinvest these rewards into their business, further boosting their growth and profitability.

Thorn, a nonprofit organization focused on combatting human trafficking, has benefited from Brex’s streamlined financial services. With Brex’s credit card and cash management tools, Thorn has been able to efficiently manage its financial operations, freeing up valuable time and resources to focus on its mission and impact.

These success stories demonstrate the power of Brex in enabling startups to overcome financial challenges and achieve their goals. By providing startups with the tools, resources, and financing options they need, Brex has become a trusted partner in the journey to startup success.

The Technology Behind Brex

Brex utilizes advanced technology to provide seamless and efficient financial services to businesses. The company leverages data-driven algorithms, artificial intelligence, and machine learning to streamline processes, automate tasks, and offer real-time insights to its users. Brex’s innovative technology enables businesses to manage their finances more effectively, make data-driven decisions, and optimize their financial operations.

Brex

Security First: Keeping Your Business Safe with Brex

Brex understands the importance of security when it comes to your business. That’s why we prioritize the protection of customer data and transactions with industry-standard encryption and security measures. Our commitment to security goes beyond the basics. We follow strict compliance protocols and regularly undergo security audits to ensure that your business remains safe and secure.

Customer Support and Resources

At Brex, we believe in providing exceptional customer support to assist businesses every step of the way. Our dedicated support team is available via phone, email, and chat, offering prompt and personalized assistance to address any inquiries or issues you may encounter. We understand that your time is valuable, and we strive to provide quick resolutions to your concerns.

In addition to top-notch customer support, Brex offers a wealth of resources to help businesses maximize the benefits of our financial tools. Our comprehensive guides, articles, and FAQs provide valuable insights and tips on how to make the most out of your Brex experience. Whether you need assistance with expense tracking or want to explore different ways to grow your business, our resources are here to help.

Conclusion

The future of business finance is being revolutionized by Brex, a financial technology company at the forefront of financial innovation. With its advanced technology, user-friendly platform, and tailored products, Brex is empowering businesses to manage their finances more efficiently and effectively.

By joining the Brex community, forward-thinking businesses can take the next step in their financial journey. Through a simple online signup process, companies gain access to cutting-edge financial tools, expert support, and valuable resources that fuel growth and success.

With Brex, businesses can stay ahead of the curve and navigate the evolving financial landscape with confidence. Experience the future of business finance by joining the innovative Brex community today.